Student Budget Template

Creating a student budget template is an essential step for any student looking to manage their finances effectively. With the rising costs of tuition, living expenses, and other necessities, it's crucial for students to track their income and expenses to ensure they stay within their means. A well-crafted budget template can help students prioritize their spending, make smart financial decisions, and achieve their long-term goals.

Understanding the Importance of a Student Budget Template

A student budget template is a tool that helps students allocate their financial resources wisely. By categorizing income and expenses, students can identify areas where they can cut back on unnecessary spending and make adjustments to achieve a balanced budget. A budget template can also help students develop healthy financial habits, such as saving for emergencies, paying off debt, and building credit.

Key Components of a Student Budget Template

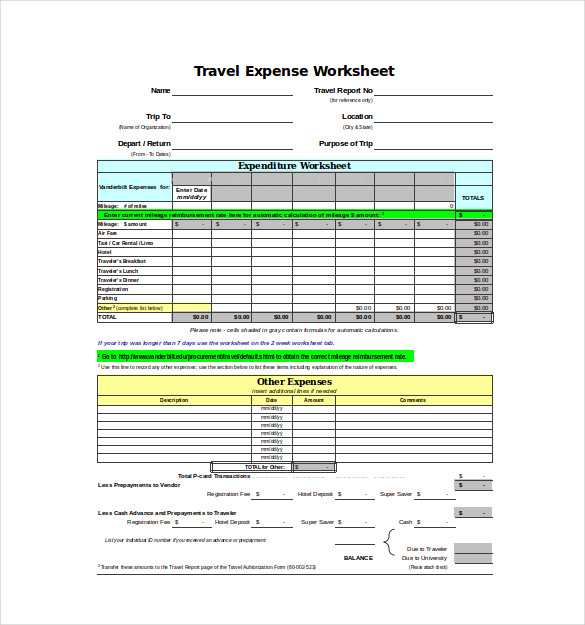

A comprehensive student budget template should include the following components:

- Income: This includes any financial aid, scholarships, part-time jobs, or other sources of income.

- Fixed Expenses: These are essential expenses that remain the same each month, such as rent, utilities, and tuition.

- Variable Expenses: These are expenses that can vary from month to month, such as groceries, entertainment, and transportation.

- Savings: This includes any money set aside for short-term or long-term goals, such as building an emergency fund or saving for a car.

- Debt Repayment: This includes any debt, such as student loans or credit card balances, that needs to be paid off.

| Category | Monthly Allocation |

|---|---|

| Income | $2,000 |

| Fixed Expenses | $1,500 |

| Variable Expenses | $500 |

| Savings | $200 |

| Debt Repayment | $100 |

Creating a Customized Student Budget Template

To create a customized student budget template, follow these steps:

- Track your income and expenses for a month to understand your spending habits.

- Categorize your expenses into fixed, variable, and savings.

- Set financial goals, such as saving for a car or paying off debt.

- Allocate your income into each category based on your goals and priorities.

- Review and adjust your budget regularly to ensure you’re on track to meet your goals.

Tips for Managing a Student Budget Template

Here are some additional tips for managing a student budget template:

Automate your savings by setting up automatic transfers from your checking account to your savings or investment accounts.

Take advantage of tax-advantaged savings options, such as 529 plans or Roth IRAs, to save for long-term goals.

Avoid impulse purchases by creating a 30-day waiting period for non-essential purchases.

Use the 50/30/20 rule as a guideline for allocating your income: 50% for fixed expenses, 30% for variable expenses, and 20% for savings and debt repayment.

What is the best way to track my expenses?

+There are several ways to track your expenses, including using a budgeting app, spreadsheets, or even just a notebook. The key is to find a method that works for you and stick to it.

How often should I review my budget?

+It’s a good idea to review your budget at least once a month to ensure you’re on track to meet your financial goals. You may also want to review your budget more frequently if you have a lot of variable expenses or if you’re trying to pay off debt.

What are some common budgeting mistakes that students make?

+Some common budgeting mistakes that students make include not tracking their expenses, not accounting for variable expenses, and not saving for emergencies. By avoiding these mistakes, you can create a more effective budget that helps you achieve your financial goals.